Lenders can look at your DTI to see simply how much you owe compared to how much you have made. To help you qualify for a normal loan, most lenders choose a good DTI out of 50% or shorter, while some loan providers can offer certain liberty.

Deposit

With the development of this new housing marketplace and lower interest rates into the discounts profile, lenders are now ready to deal with as low as step 3% payday loans Cannondale down.

This is actually the connect: For people who pay below 20% down, lenders will in all probability charge you a great deal more from inside the interest, and they’re going to would also like you to definitely purchase individual financial insurance policies (PMI).

Proof of earnings and you may work

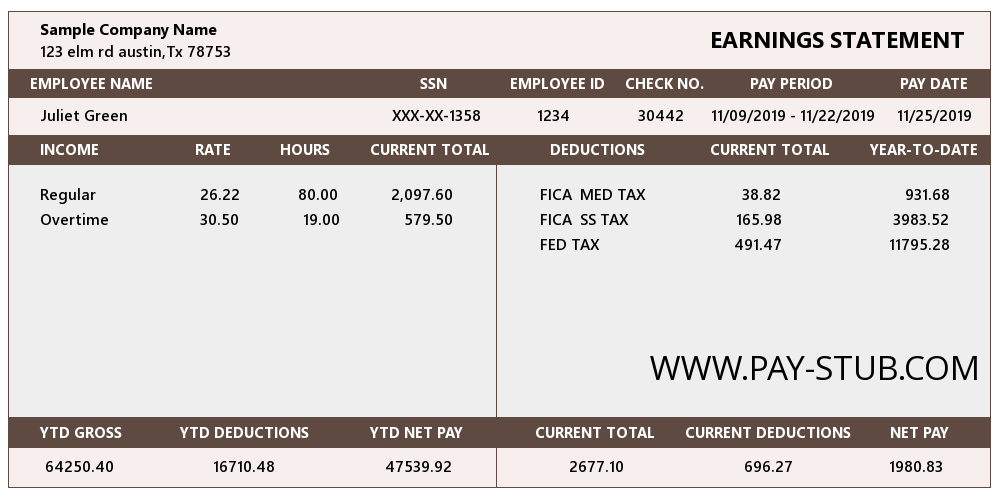

To own a normal mortgage, loan providers need to observe that you get adequate to create their normal monthly payments. To ensure, they’re going to want to see evidence of money. Typically, they are going to consult current pay stubs and you will W-2 forms.

Now that you understand what a normal loan try, it is time to look at the sorts of antique finance you to definitely is actually out there.

Fixed-rate mortgage loans

The speed because of it financing stays a comparable over the life of the mortgage. Your commit to obtain some currency and shell out it right back on a predetermined rate of interest more a predetermined several months of your energy. Using this type of particular loan, you always understand what you are investing each month.

Adjustable-rates mortgage loans

Which have a varying-price mortgage, the interest rate was varying, which means it can increase otherwise down across the life of the financing.

Adjustable-speed mortgages always give a lower life expectancy-than-mediocre rate of interest on the very first step 3 10 years. After that, the pace changes predicated on terms you and your lender arranged so you can beforehand.

While the a home customer, adjustable-rates mortgage loans will be beneficial if for example the borrowing causes it to be harder to track down an effective rate of interest or if you simply intend to stay static in your home to possess step three a decade.

Very conforming mortgage loans

Freddie Mac computer created super compliant fund getting individuals who wish to obtain more the new restrictions place because of the Fannie mae and you may Freddie Mac and you will live-in high-property-worthy of elements.

By 2021, awesome conforming financing limits to have mortgage loans try $822,375 for starters-unit characteristics and can go all the way to $step one,581,750 to possess a several-tool property.

Home recovery financing

When you are to acquire an effective fixer-upper, such conventional loans can help you pick a house and just have the cash you really need to fix and redesign.

Think about Traditional Nonconforming Funds?

These types of fund have positives, such as letting you acquire more income, but mortgage brokers convey more capacity to put the new terms and conditions and criteria.

Old-fashioned vs. Jumbo finance

If you’re looking to get big while do not be eligible for an excellent conforming real estate loan, you could potentially speak to your lender on an effective jumbo loan.

Such money can be used to obtain over the compliant mortgage limits and usually want large credit ratings and you can a down payment of at least 20%.

Was a traditional Mortgage My personal Best option?

For most borrowers with very good credit, the answer was sure, nonetheless it hinges on individual condition and you may monetary specifications.

After the 2008 economic crisis, government-backed financial financing spiked. What number of lenders capitalizing on FHA and you will Virtual assistant finance increased up to 3 hundred%.

Ever since then, Fannie mae and you can Freddie Mac computer are creating the brand new conventional loan applications (including Federal national mortgage association HomeReady and you may Freddie Mac computer Home Possible ) that provide consumers certain great things about non-old-fashioned mortgage loans without the need to meet the same qualification standards out of a great Virtual assistant loan or a keen FHA loan.

Have always been We qualified to receive a traditional home mortgage?

When you have a constant income, a credit history out-of 620 or even more while commonly overloaded in debt, you will be qualified.