You may be training a free of charge blog post having opinions which can change from The Motley Fool’s Superior Using Attributes. Getting an excellent Motley Deceive associate right now to get instant access to help you all of our ideal analyst information, in-breadth lookup, using tips, and. Discover more

A credit rating out of 700 or higher can help you score that loan during the lower costs and gather larger incentives to the handmade cards or other lending products.

A credit history regarding 700 is regarded as “good” because of the FICO, and although it is really not for the “pretty good” or “exceptional” area, it has to meet the requirements your for the best words of many fund. Here’s how you can utilize your credit rating to locate down interest rates and you may maximize the key benefits of good credit.

Exactly what good FICO get from 700 can get you

No matter if a great 700 credit rating seems fairly higher centered on the official FICO rating set of 3 hundred to help you 850, its just average, considering FICO studies out of . To place it in the position, more or less 43% regarding credit ratings along side Us try less than 700. Of course, the typical fluctuates. In 2009, eg, the common credit rating was straight down considering the economic crisis.

Regardless, that have a score out-of 700 or maybe more should set you up for the majority of of the finest rates and you may conditions on playing cards, car loans, and you may mortgages.

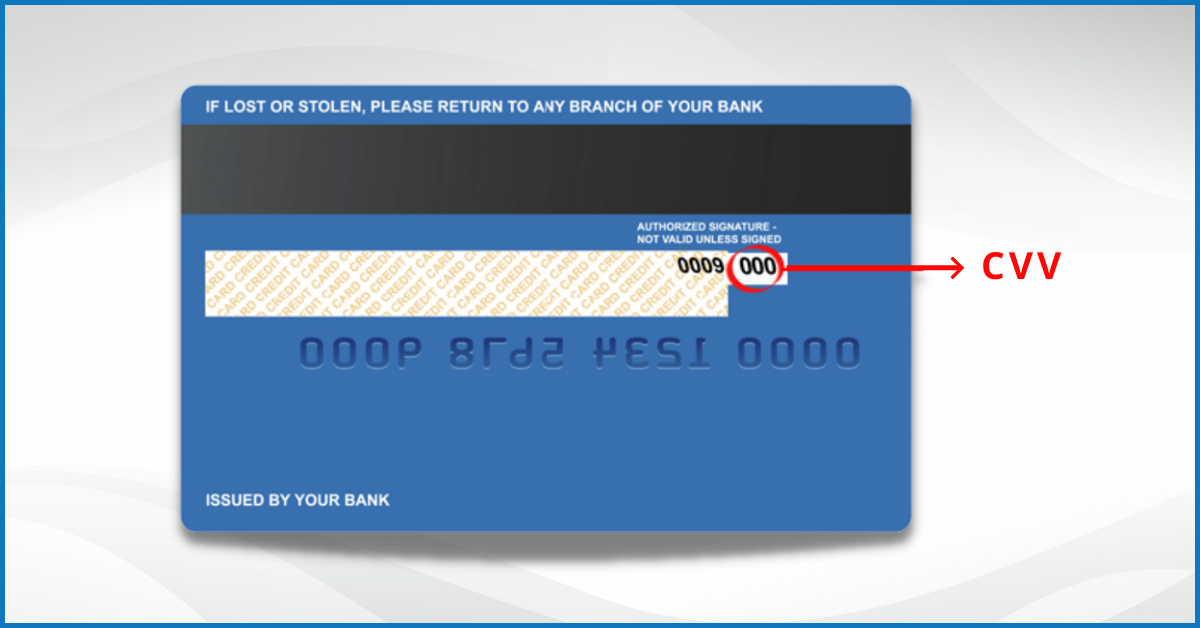

- Credit cards — You are able to qualify for very playing cards, although some of one’s highest-stop cards may be out of come to. (A high earnings is meet the requirements you having credit cards available for people who have sophisticated borrowing from the bank, even though you enjoys otherwise “good” credit.)

- Car and truck loans — Possible be eligible for an informed pricing for the car loans, while the greatest words are usually available to individuals with credit scores out of 700 or even more. Once you’ve topped 700, their interest rate is much more significantly influenced by your income, the size of your own down payment, and vehicle you happen to be to find.

- Mortgage loans — Underwriting are extremely strict regarding mortgage loans. Generally, borrowers with a get from 700 to 759, hence mortgage lenders consider “best,” will have an interest rate simply 0.twenty-five fee affairs greater than borrowers having a rating regarding 760 or maybe more — and therefore loan providers essentially consider “very prime.” (Come across mortgage cost in your neighborhood in the Fool’s financial center.)

If you are looking to acquire a house, it makes sense to function towards the enhancing your credit rating before you submit an application for home financing. Below are a few things you can do:

- Pay down the stability — With credit cards harmony more than 30% of borrowing constraints (more than $1,five-hundred into the a card which have good $5,000 credit limit, such as for example) can be damage the get. Try to keep their balances as low as you’ll be able to. Fortunately, balances is reported at least once 1 month, thus repaying a balance can very quickly lead to a better score.

- Assess exactly how your repayments impact the limit loan amount — Loan providers use an elementary ratio to determine how much you can afford to obtain. By paying off financing, you’ll change your ” proportion,” allowing you to be eligible for a more impressive financial.

- Dont discover one this new membership — If you are planning locate home financing within the next 12 months, it’d getting smart to avoid and work out people the latest applications to possess credit. You should never discover a charge card, financing a different automobile, otherwise invest in place a household get for the a shop card for individuals who expect you’ll glance at the home loan underwriting procedure one time in the future. The fresh account commonly temporarily depress your rating and care and attention the bank that you could be desperate to borrow funds.

Re-finance dated bills

Whether your credit score strikes 700 in route right up, your ple opportunity to money in by refinancing your existing bills during the a lower rate. Student education loans, auto loans, and mortgages could all be refinanced within a lowered price if the you have got a not too long ago improved credit rating.

Clearly, handling a credit rating from 700 or higher can help to save you a lot of cash in your car loan. Similar offers are available for those who re-finance student education loans and you will mortgage loans once growing its credit ratings. If you begin doing your research in order to re-finance a loan, you will need to realize some basic guidelines to cease a negative perception into credit history. Towards the purposes of calculating your credit rating, all borrowing from the bank concerns within a beneficial 45-day months try combined towards the you to. Since your credit history would otherwise grab a little hit that have all of the inquiry, it is smart to get all of your current re-finance rates contained in this a good forty-five-day time figure.

Cash in with credit cards

If you don’t intend to get a mortgage or refinance people existing financial obligation, at the very least think getting an advantages mastercard. Through powerful race to own charge card consumers, banking companies have to give you friendly terms so you’re able to consumers with credit ratings over 700. Particular such as good now offers have cash-straight back rewards notes and you may travel handmade cards.

- Traveling notes — A couple of most useful-rated travelling cards offer brand new cardholder incentives value more than $five hundred towards the take a trip to own accredited applicants. This type of notes can go a considerable ways to the letting you spend having a vacation, however you will must see a minimum purchasing needs, that will be as high as $4,100000 within the 3 months (everything $step 1,334 a month). The optimum time to join one among these cards may be when you find loans Parrish AL yourself already browsing build a major pick you could pay for which have vinyl.

- Cash-right back cards — The 3 dollars-straight back notes i score large from the Deceive provide $five-hundred of brand new cardholder incentives with lowest using requirements zero high than $step one,100 in the 1st 3 months (roughly $334 out of investing four weeks). Mastercard indication-right up bonuses can be one of an educated an easy way to work with out of playing cards for those who have a rating more than 700, as best incentives try kepted for folks who have a good borrowing.

- 0% introduction Apr — If you intend and then make a primary buy, an excellent 0% introduction Apr credit card will be an intelligent pick. Which have as much as 21 days regarding no notice towards the the latest requests, such cards makes it possible to funds an enormous arranged pick (eg a separate roof on your domestic, such). Likewise, individuals with credit debt is to try to find a balance transfer bank card so you’re able to efficiently refinance their present personal credit card debt in the an effective 0% promotion rates for over one to full season.

Obviously, new economic great things about most readily useful-level handmade cards merely make sense for those who won’t carry a balance and thus stop repaying interest on their notes. It’s a given that perhaps the most readily useful rewards apps is be much more than simply offset by interest, that will add 18% or even more of stability yearly. Ergo, handmade cards would be best made use of instead to have debit notes, used just to pick what you can manage to buy with dollars.

Michael jordan Wathen doesn’t have reputation in any of one’s brings said. The fresh new Motley Deceive has no condition in almost any of one’s stocks said. The newest Motley Deceive possess a good revelation coverage.