Second homes are becoming costly, and you may house hunters will be view rates, upfront charge, restoration fees and you can fees whenever calculating the cost.

Need for second belongings provides ramped right up over the past couples regarding years since the affluent People in the us fled heavy urban centers to get more elbow space and a better consider.

The fresh new interest in 2nd – otherwise 3rd – land is out of the world, said Bill Hernandez, a real estate representative away from luxury residential property during the Southern Fl having Douglas Elliman.

Seventy percent of respondents into the a good 2021 federal questionnaire told you they was basically wanting a second house or already possessed that, upwards from about 60 percent the entire year prior to, according to RCLCO, a bona fide home consultative organization you to used the fresh new survey.

We have seen certain interesting change, specifically certainly millennials within their 30s and you may forties, have been gaining plenty of wealth, told you Kelly Mangold, a primary from the RCLCO. The rise out of secluded works altered the new calculus to possess much out-of household on the capacity to alive somewhere else for bits of https://speedycashloan.net/loans/low-interest-personal-loans/ the year.

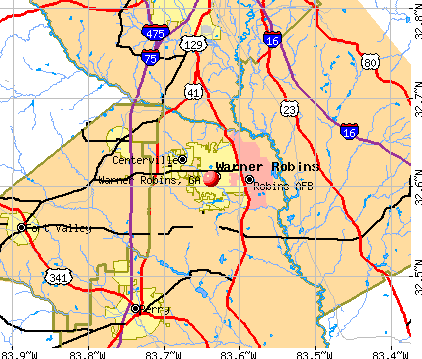

Favorite Next-Household States

Florida and you will Ca better the menu of the fresh new says extremely popular to have next home, based on a study out of a bona fide property asking corporation.

But prices for to shop for a moment house are getting up so it seasons, that’ll cool the fresh red-colored-sensuous sector. Towards the Wednesday, the Federal Set-aside improved their key interest rate of the a quarter from a portion area, together with Federal Housing Funds Institution states it will improve initial costs for the 2nd house.

Next property are generally used not totally all months out-of the entire year, making it critical for people to consider the expenses prior to signing an agreement, home professionals state. Specific says, such as for example Fl, possess a standing up months once a binding agreement was signed, giving customers more time to accomplish the homework, but it is crucial that you research the business prior to beginning the latest look for a home.

Protected A mortgage Rate

Mortgage prices fluctuate every single day, however they are rising. The fresh Government Put aside have estimated half dozen more price grows this year, and work out borrowing from the bank higher priced to have banks, which in turn pass on the higher costs to help you people. Home loan rates are also impacted by rising prices, which is during the a forty-year higher. To safeguard oneself out-of highest home loan rates after, set your rate as soon as possible.

Buyers counting on financing is line up its mortgage recognition well before making an offer on property, Mr. Hernandez said. Property buyer in the industry today get a good 90-date rates lock, the guy told you.

As a way to tamp off soaring rising cost of living, the latest Given plus told you it can beginning to compress the balance piece out of thread holdings, that’ll tense bank credit for mortgages or any other finance.

An average rate for a thirty-12 months fixed-rates financial is cuatro.16 % into the February 17, upwards regarding step 3.09 per cent last year, based on Freddie Mac, the borrowed funds finance monster. Would like to know the rate you might get? The consumer Monetary Cover Agency has a convenient on the web device to help you help potential home buyers know very well what mortgage price they’re able to predict in just about any condition.

Discuss Settlement costs

Mortgage loans normally have initial costs, as well as appraisal charge and you will pro rata assets taxes. Some are standard, however, buyers seeking to remove the closing costs normally discuss certain charges with lenders on third-people properties, for example insect monitors.

You to definitely initial prices is going to diving: The fresh Federal Houses Money Department told you within the January one to, as a way to help reasonable casing, it might help the upfront charge the following month to have mortgage loans on a moment home sold so you’re able to Fannie mae and you may Freddie Mac computer because of the up to step 3.9 %.

Beneath the plan, a buyer having good $300,100000 financial and you may loan-to-worthy of ratio away from 65 per cent, particularly, will pay an additional $4,875, according to the Federal Organization off Home Builders, which includes compared the master plan, saying it will boost the cost of homeownership.

Scrutinize Maintenance Charge

Condos or any other planned advancements routinely have a home owners organization that holds the latest profit of your own area because of monthly repair charge, which are in line with the sized new cutting-edge and you will the sort of facilities that will be protected. Financial institutions tend to consider HOA charge whenever choosing how big good mortgage, thus highest charges you may get off a debtor which have a smaller sized mortgage.

Consumers need to learn what the fees try and you can whether the connection keeps currency stashed inside a rainy-date financing, told you Bryan Sereny, Mr. Hernandez’s spouse within Douglas Elliman. And additionally they need to have disclosures of every upcoming examination, he additional.

They wish to take a look at supplies to be sure there is money in the financial institution in the eventuality of unseen fix, he told you. They don’t need whacked with an evaluation.

Make use of Income tax Holidays

Tax holiday breaks are available to residents, including write-offs for assets taxes and appeal to your home loan repayments, in the event the its 2nd home is meant for personal explore.

To simply help defray the costs out of maintaining a moment house, whether or not, specific citizens you’ll rent out the property, particularly when he or she is planning real time indeed there later, said Henry J. Grzes, lead director getting tax habit and integrity with the American Institute regarding Authoritative Public Accountants.

Owners of funding characteristics be eligible for most other taxation holidays, also deductions to own restoration and you can decline, with regards to the I.R.S. Youre allowed to subtract doing $25,100000 inside losings in virtually any seasons, the guy said.

Most other taxation savings are around for people which be eligible for coupons. Pay their tax bill very early, he said, and check out such things as updates to the utilities because of times credit like solar power.