Non-people in the fresh Navy Federal Credit Partnership will be unable to apply for a personal bank loan using this bank. Plus, if you are $fifty,100000 is going to be sufficient for the majority borrowers, it is not sufficient for everybody. Keep in mind that most other loan providers can get match your requires.

Moreover, NFCU doesn’t create individuals to improve their fee due date, regardless of changes in one’s financial situation. When the later on the percentage, consider that a belated percentage payment away from $30 could well be added to the balance.

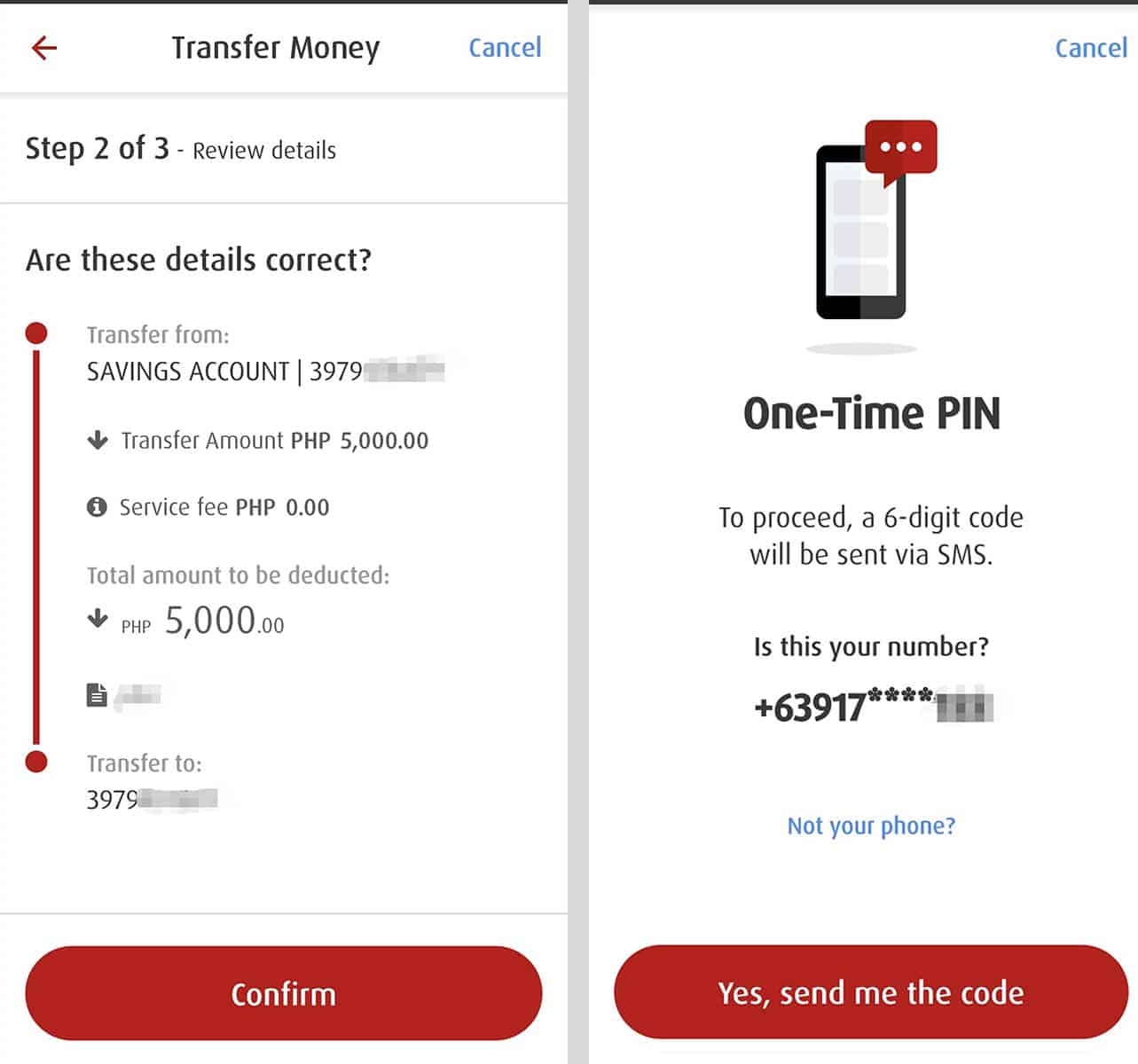

To aid you regarding loan application process regarding Navy Government, MoneyGeek has noted the important steps. Plus checking if you be considered, you’ll need to sign up mode and you may, upon recognition, review and signal agreements.

Prequalify

In order to prequalify, you need to earliest ount called for, loan terminology you’re ready to invest in additionally the purpose of the mortgage. Thanks to mellow credit inspections during this techniques, your credit rating will never be negatively inspired.

Fill in Form

You will end up required private information such as your phone number and you will email. In addition to, has helpful everything of your co-candidate, in the event the relevant. This will include day regarding beginning, target, contact number, current email address, income, employer’s name and you will phone number, Social Security Amount and you may NFCU Accessibility Amount. You could fill out the net setting, make use of the application, call 1-888-842-6328 otherwise check out an excellent NFCU department to utilize.

Anticipate Recognition

After you upload your documents and you may finish the verification measures, your loan will be analyzed from the NFCU’s underwriting people. Look at the standing of one’s app daily and watch for a beneficial reaction.

Feedback Loan Agreement

Very carefully review the loan promote. The latest acknowledged amount borrowed you certainly will change from what you expected. Be sure to and your financial take a comparable page.

Indication Mortgage Arrangement

If you have very carefully examined and you can provided to the borrowed funds conditions, you could potentially sign new contract. Signing electronically try an alternative.

Discovered otherwise Direct Funds

In case your procedure was finished in a fast trends, you could found their registered mortgage a comparable date. The cash is myself deposited into the checking account.

Generate Costs

Repayments can be made from the on line banking, through the app or higher the phone. When you’re a recent member or a veteran having lead put, you might establish autopay to get the money become subtracted from your own account instantly, saving you 0.25%.

How to proceed when you’re Declined Away from Navy Government

If you were refuted a personal bank loan, usually do not become frustrated. There are various most other lenders where to select. It is likely that your application are turned down because you don’t meet what’s needed. Lenders could possibly get refuse applications on account of lowest credit ratings, decreased papers, too little credit score or other causes.

In the event that rejected, an educated move to make will be to inquire from what cause for assertion of app. Perhaps you can make modifications on application, like the amount borrowed or percentage words. Or even, next at the least you know how to improve the application. You can find a personal loan away from a special merchant.

Frequently asked questions From the Signature loans

To greatly help customers to their consumer loan trip, we responded specific faqs in the Navy Federal unsecured loans. If you find yourself there are pros and cons to that particular merchant, you should assess whether it’s an educated bank for you predicated on your circumstances and budget.

NFCU is actually for people just and does not wanted the absolute minimum credit score. Having said that, candidates will have a better threat of approval and you may a diminished price that have at least a fair credit history.